Mizuho Leasing purchases property or equipment for the customer from the owner and leases it to the customer.

The most common finance lease transaction is where the customer pays back the cost of the property or equipment through lease payments.

Merits

・Fund procurement ・Cost spreading ・Off balance sheet accounting

The residual value of the asset at the end of the lease period is set beforehand, allowing the customer to benefit from favorable leasing fees.

Merits

・Lower total payments ・Off balance sheet accounting

・Fund procurement ・Cost spreading

Mizuho Leasing purchases property or equipment for the customer from the owner and sells it to the customer in installments.

Merits

・Fund procurement ・Cash flow smoothing

Real estate leases can be designed to meet the specific needs of each customer. By avoiding outright ownership of an asset, customers can spread the initial purchase cost or exclude the asset from their balance sheet.

Merits

・Fund procurement ・Cost spreading

・Off balance sheet accounting (In the case of operating leases.Provided by ML Estate Company, Limited)

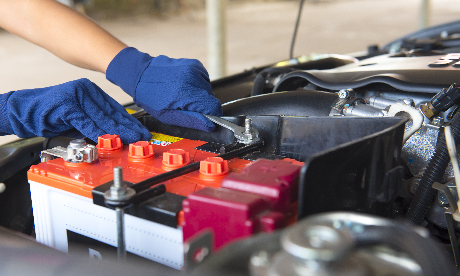

(Provided by Mizuho Auto Lease Company, Limited)

Vehicle fleet management typically requires input from general affairs, accounting, sales and other divisions within a company. Fleet management also involves negotiations with insurance, vehicle maintenance and other companies.

Auto leases allow customers to outsource all their fleet management activities, helping to lower personnel and administration costs.

Merits

・Efficient fleet management ・Cost savings

(Provided by Mizuho Auto Lease Company, Limited)

Mizuho Auto Lease provides maintenance services for vehicle fleets owned by customers.

CCS contract periods are flexible, allowing customers to pick the level of service that best suits their needs.

Merits

・Efficient fleet management ・Cost savings

Mizuho Leasing takes on responsibility for all payables such as fees for engineering work, which the customer then repays to Mizuho Leasing in installments.

Merits

・Fund procurement ・Cash flow smoothing

Mizuho Leasing purchases notes receivable held by customers.

Merits

・Rapid monetization ・Off balance sheet accounting

・Mitigation of receivables recovery risk

Mizuho Leasing provides leases with optimum contract conditions to suit customer needs and local accounting and tax systems.

We also provide lease back arrangements for facilities already owned by companies through their overseas subsidiaries.

Merits

・Fund procurement ・Financing in local currencies

・Accounting and tax benefits (depending on the country)

Mizuho Leasing purchases assets from sellers and transfers them to overseas subsidiaries through sales installments.

We also offer Trade Packages, a one-stop scheme combining trade and logistics functions and financing functions.

Merits

・Fund procurement ・Additional trade and logistics functions

・Access to low Japanese yen and US dollar interest rates

This scheme allows customers to transfer property under lease contracts (or installment sales contracts) to overseas locations.

The use of contracts normally used in Japan makes the process simple.

Merits

・Fund procurement ・Simple contract procedures

We provide leases and other financial support to help customers sell their products.

Our menu of services can be tailored to the specific needs of customers to support sales promotion.

Merits

・Diversification of sales approaches

・Rapid recovery of accounts receivable

(Provided by ML Shoji Company, Limited)

ML Shoji purchases idle machinery from customers and sells a wide range of used machinery and equipment, such as machine tools, industrial machinery, printing equipment, injection molding machinery, woodworking machinery, food machinery and forklift trucks.

Merits

・Cost reduction