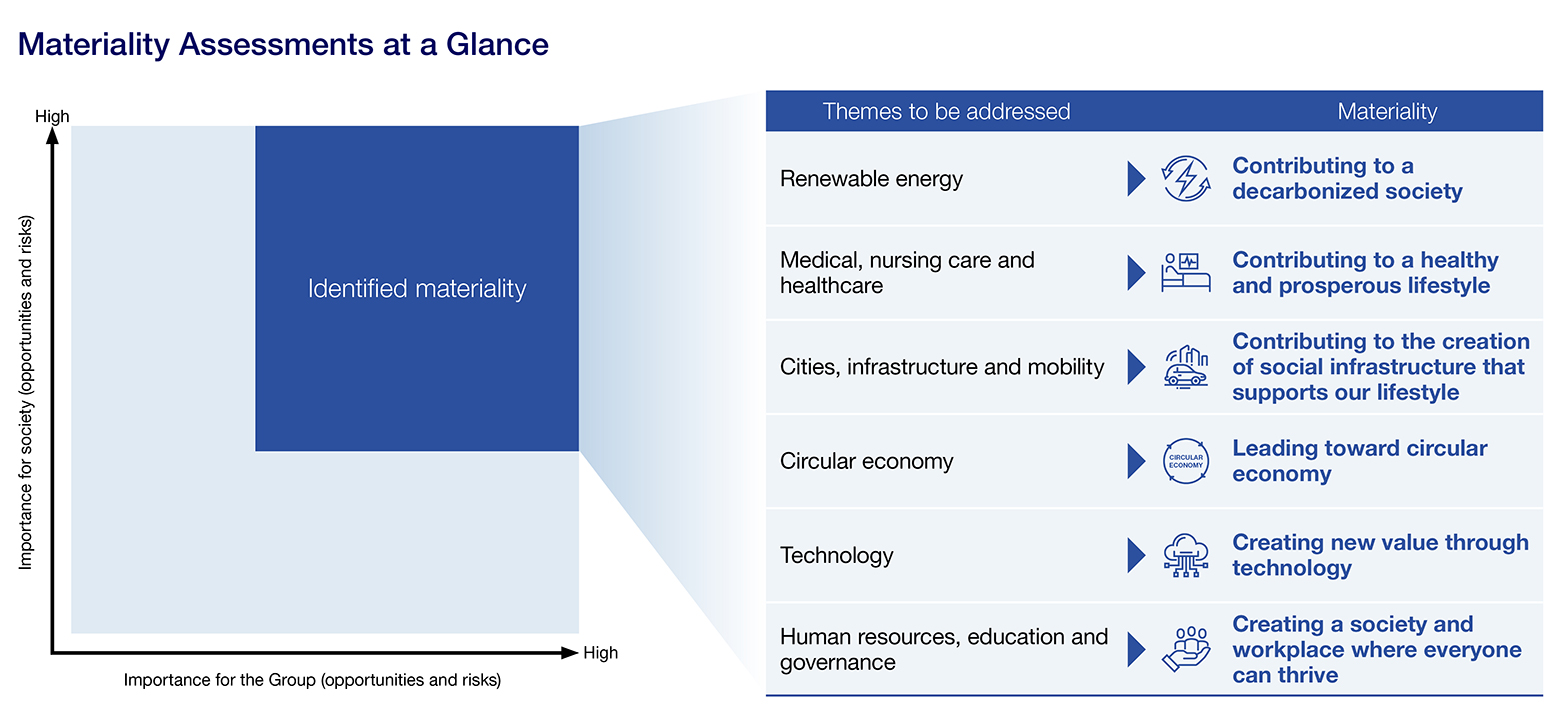

Climate change, in the form of increasing levels of greenhouse gases and rising temperatures, is one of the major challenges facing the world today. The Group takes the issue of climate change seriously and has set “contribution to a decarbonized society” as one of the materiality issues in its Sustainability Initiatives, which it will work to solve through its business activities.

At the same time, by conducting analysis and disclosure in line with the Task Force on Climate-Related Financial Disclosures (TCFD) under an appropriate governance and risk management framework, we will develop a deeper awareness of the risks and opportunities posed to the Group by climate change issues and take action to achieve a sustainable society.

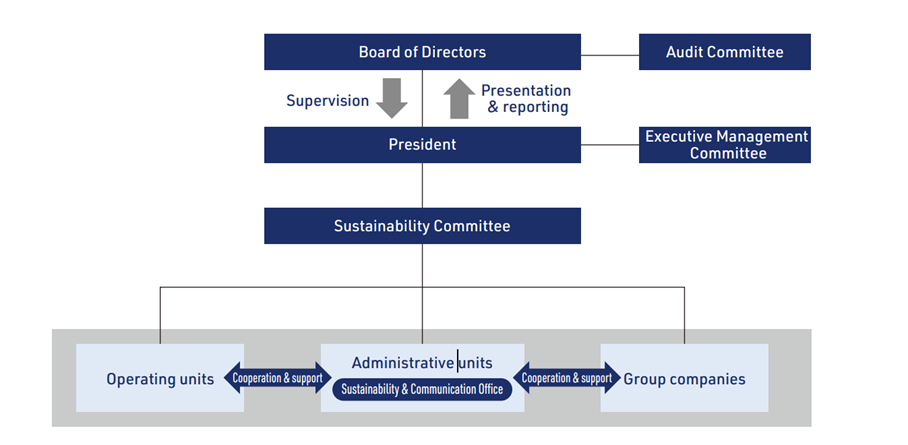

In April 2022, we newly established a Sustainability Committee to conduct cross-sectional company-wide discussions on climate change. The committee is headed by the Chief Sustainability Officer and consists of the CFO、CSO、CRO、CIO、CCO, and executives in charge of ESG-related divisions. In principle, wide-ranging discussions are held on a quarterly basis, and depending on the topic of discussion, other related parties are also invited to attend.

Specifically, the committee shares information relating to sustainability, including ESG, develops basic policies and targets for sustainability management, monitors the implementation status of plans and discusses countermeasures, and has begun discussions on issues such as addressing climate change, sustainability initiatives, and management in response to environmental changes.

Topics are deliberated on, reported to the Management Committee for discussion, and then reported into turn to the Board of Directors, where they are discussed and reflected in business strategy. In addition, a system is in place to ensure appropriate oversight by the Board of Directors, in which quarterly reports are made to the board on the status of climate change measures and performance evaluations with respect to targets and indicators.

The Group takes the various risks and management associated with climate change as one of its key strategic perspectives. Identifying “contribution to a decarbonized society” as a materiality issue, it is promoting initiatives to address it accordingly.

In these efforts, we are assessing not only the short-term impacts of climate change but also those that may become apparent in the medium- to long-term. The impact periods are defined as short-term (1–5 years), medium-term (10 years up to 2030, the year by which the Japanese government aims at 46% reduction of greenhouse gas emissions), and long-term (30 years up to 2050, the year by which the worlds aims to achieve carbon neutrality).

The main impacts on the Group of the transition risks/opportunities and physical risks/opportunities associated with climate change are shown in the table below.

|

Type |

Main Points |

Timeframe |

|

|

Transition risk |

Policy |

Increased cost of credit to sectors with high greenhouse gas emissions due to the introduction of carbon taxes and carbon pricing |

Medium- to long-term |

|

Regulation |

Increased costs associated with responding to regulatory changes based on increased international compliance requirements, such as stricter emissions reporting obligations |

Short-term |

|

|

Physical risk |

Acute / Chronic |

Decrease in asset values, limitation of business activities, and increased restoration costs due to damage to existing company assets caused by wind and flood damage as a result of severe extreme weather events |

Short-, medium-, and long-term |

|

Opportunity |

Increased demand for financing and business opportunities associated with the shift to renewable energy and more energy-efficient transportation methods, as well as the dissemination of environmentally friendly or resilience-focused products and services |

Short-, medium-, and long-term |

|

We expect the entire company to be affected by greenhouse gas (GHG) emission regulations and extreme weather events, as well as by increased demand for financing for projects related to renewable energy and energy-efficient properties. We have also established a sector policy that we will not provide investment or other financing for the construction of new coal-fired power plants, thereby making decisions on deals in consideration of climate change risk.

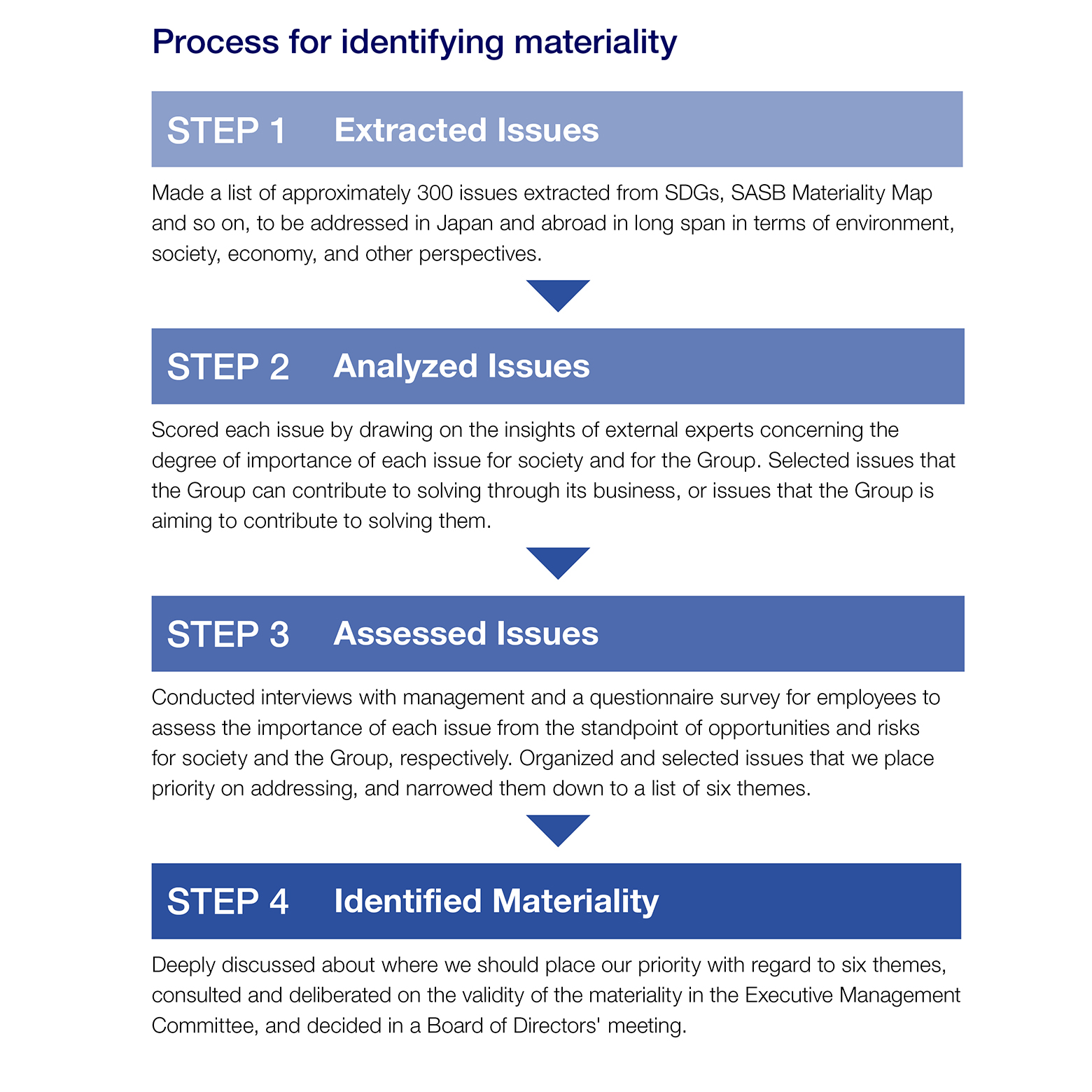

In order to understand the highly uncertain impacts of climate change, including the associated transition and physical risks, multiple qualitative scenario analyses were conducted on sectors of high importance, using the following steps.

(1) Sector selection

The sectors for which the TCFD recommends to discloseure (i.e., those sensitive to climate change) were classified in terms of importance to the Group based on

- Qualitative assessment of the magnitude of transition and physical risks due to climate change,

- The Group’s exposure in each industry, and

- Strategic importance.

On this basis, we identified the electric power and real estate sectors for scenario analysis.

(2) Evaluation of importance

The importance of risks and opportunities for the electric power and real estate sectors were evaluated based on their magnitude of business impact.

(3) Defining scenario groups and setting parameters

Highly objective scientific parameters were used to estimate the timing and magnitude of the impacts. (Source*)

(4) Evaluation of business impact

Climate change risk transitions were assessed up to 2050 based on two scenarios, under 1.5–2℃ and 4℃, with reference to the IEA(*1) WEO(*2) 2021 NZE(*3) scenario and the IEA WEO2021 STEPS scenario.

*1 IEA: International Energy Association, *2 WEO: World Energy Outlook, *3 NZE: Net Zero Emissions

Sources*

- Japan: Climate Change Summit Declaration (22/4/2021)

- EU: Draft commitments from individual countries

*EU: Belgium, Bulgaria, Czech Republic, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, and Sweden - WRI “The Aqueduct Global Flood Analyzer”

- National Oceanic and Atmospheric Administration (NOAA) “Global Warming and Hurricanes" (September 2021)

- IEA “Energy Technology Perspective 2017”

- IEA “World Energy Outlook 2018”

- IEA “World Energy Outlook 2021”

- Ministry of Economy, Trade and Industry “Policy Trends for Promoting the Spread of ZEH and Related Budget Proposals for FY 2018” (March 2018)

- Sustainable Open Innovation Initiative, Net Zero Energy House Support Project

- Briefing on ZEH 3 Ministry-Coordinated Policies (Ministry of the Environment)

- xymax “Economic Analysis of Environmental Management”

- Technical Study Group on Flood Control Planning in Consideration of Climate Change, “Proposal for Flood Control Planning in Consideration of Climate Change”

- JMA Website “Past and Future Sea Level Changes around the World”

- Ministry of the Environment et al. “Synthesis Report on Observations, Projections and Impact Assessments of Climate Change, 2018 - Climate Change in Japan and Its Impacts”

- JMA “Climate Change Monitoring Report 2020”

<Electricity Sector>

The results of the scenario analysis for the electric power sector were as follows.

|

2℃/1.5℃ Scenario |

4℃ Scenario |

|

|

Risks |

Although the introduction of a carbon tax, stricter carbon emission regulations, and changes in the energy mix are expected to reduce fossil fuel use after 2030, which will have an impact on the profitability of electric power companies, in our case, the impact on credit costs will be limited. In addition, we are not engaged in business management involving coal-fired power generation, etc. |

In the future, frequent flooding is expected to cause damage to power generation facilities and other equipment. In addition, higher oil prices are expected to increase the cost of power generation, affecting the profitability of electric power companies. This is expected to have an indirect impact on our credit costs. However, the direct impact on our business will be limited. |

|

Opportunities |

Considering expected growth in the renewable energy business, opportunities for market entry and investment is expected to expand. |

|

|

Measures |

[Measures to take advantage of opportunities]

|

[Risk mitigation measures] Conduct multifaceted and cautious risk assessment of individual projects, taking into account sector policies that reflect changes in the business environment surrounding us. |

Under In the 1.5–2℃ scenario, an impact on the profitability of electric power companies is anticipated, but the risks affecting us are limited, while in terms of opportunities, the renewable energy business is expected to grow. In the 4℃ scenario, we expect to see damage to power generation facilities and other assets as a result of more frequent flooding, as well as negative impacts on us from reduced profitability of electric power companies.

<Scenario Analysis for Real Estate Sector>

|

2℃/1.5℃ Scenario |

4℃ Scenario |

|

|

Risks |

Increased capital investment due to stricter energy conservation regulations and cost increases due to ZEB(*1)/ZEH(*2) mandates are expected, and if these costs cannot be passed on to tenants, credit costs may be affected in the long term due to the impact on our customers’ businesses, but the risk is limited. |

Frequent flooding is expected to cause damage to properties we are involved in, negatively affecting real estate asset values and incurring repair costs. The resulting impact on our customers’ businesses may affect our credit costs. |

|

Opportunities |

Business is expected to expand as a result of increased competitiveness for some properties and rent increase for properties with high environmental-performance due to a growing low-carbon mindset. |

Properties that are more resistant to disasters due to factors such as location and superior disaster-prevention attributes are expected to become more competitive, which will have an impact on our business. |

|

Measures |

[Measures to take advantage of opportunities]

|

[Risk mitigation measures]

|

Under 1.5–2℃ scenario, we expect some properties to become more competitive, and it is anticipated that the Group’s business will expand as it supports customers’ transition to a carbon-free society by securing a competitive edge in environmental performance. In the 4℃ scenario, if a property in which the Group is involved suffers damage from flooding or similar events in the future, this may damage the value of real estate assets and have a negative impact on the Group.

*1 ZEB: Net Zero Energy Building

*2 ZEH: Net Zero Energy House

The Group is working to expand its business to promote renewable energy and reduce environmental burden by rebuilding new social infrastructure. In light of the risks and opportunities in the electric power and real estate sectors identified by the scenario analyses, the Group will consider the effects of climate change in greater detail and reflect them in its business plans and other policies.

By engaging with and promoting financing for decarbonization, we will help our clients advance their efforts to address ESG and the SDGs, including climate change. In addition, by expanding our own business areas, we will provide solutions that meet the needs of our customers and seize the opportunities presented by environmental initiatives.

The Group categorizes the risks that arise in the course of its business operations into financial risks, which are managed quantitatively, and operational risks, which are managed qualitatively, and establishes a risk management system for each type of risk. Furthermore, by setting up Risk Management Committee, a comprehensive risk management system has been put in place to centrally manage these financial and operational risks. Financial risk can be further broken down into credit risk, market risk, and price fluctuation risk, with the location and magnitude of risk monitored based on a management framework that allocates risk capital to each category. In terms of operational risk, we monitor the incidence of, response to, and prevention of risk events such as administrative risk, system risk, and legal risk. The Group considers climate risk to relate to both financial and operational risks, and under its comprehensive risk management system, it has begun to reflect this risk in its existing risk management processes.

Among the main sectors that the Group invests in, the electric power and real estate sectors, which are considered to be particularly sensitive to climate change, are expected to face risks from the establishment of new regulations such as carbon taxes and GHG emission regulations, as well as risks of impact on business due to changes in the energy mix, more extreme weather events, and changes in customer behavior.

We view the risks posed to the Group by climate change as resulting from regulatory changes, changes in the business structure of the businesses we invest in, and shifts of clients’ behaviors. We will analyze these factors that may have a compounding effect on our business and develop more sophisticated responses to the risks.

Going forward, we will consider further enhancing our management of climate change risk under our comprehensive risk management system, taking the analytical methods and research results of relevant organizations into account.

The Group has set the following target for Scope 1 and 2.