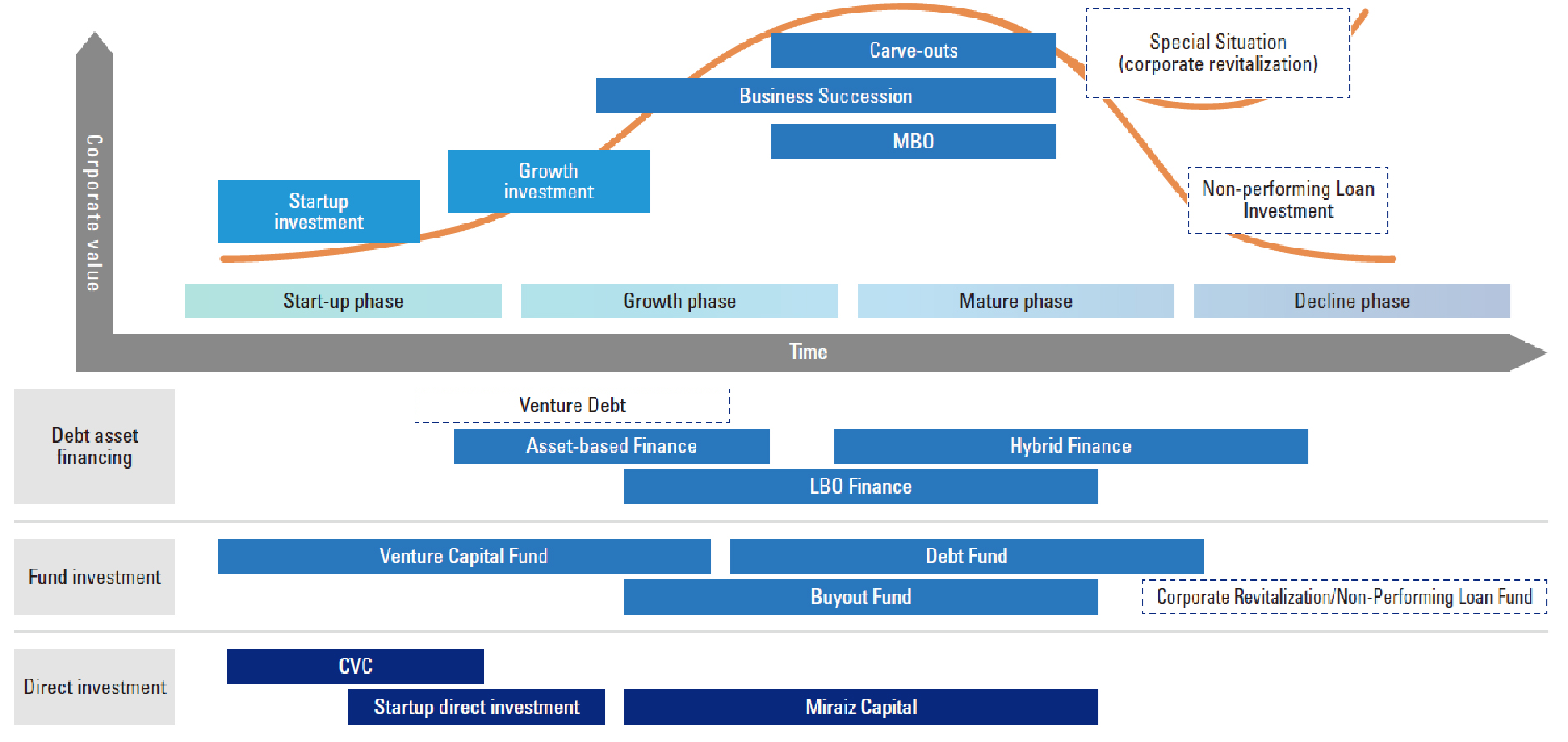

The Investment Headquarters provides financing solutions by building and managing a well-designed portfolio, focusing on investments in startups and established companies, equity and other funds, as well as middle-risk, middle-return investments in such debt instruments as LBO, mezzanine, and hybrid loans.

- Ability of accessing customer needs through the collaboration with Mizuho Group

- Effective sourcing of investment opportunities and projects from our network of partners, including Marubeni Corporation and investment funds

- Ability to provide flexible investing and financing options keyed to market conditions and the growth stages of our customers

- Strengthening direct investment in operating companies

- Promoting value co-creation through such measures as joint investment with customers

- Expanding initiatives in new financing areas such as overseas renewable energy and infrastructure projects as well as securitized products

- Providing a variety of products for customers at different stages of development and covering a variety of strategic situations

- Covers a wide range of asset classes including private equity (startup to mature) loans and equities - Preparing to offer professional services relating to corporate functions such as governance and management accounting

- Exploring global investment opportunities through networks with overseas financial institutions and fund General Partners.

- We are improving our ability to understand customers' equity needs and deepening our knowledge by defining and investigating specific themes. We are also strengthening our deal-sourcing function and collaborating on projects through the maximal use of our internal and external networks.

- We invest in opportunities that offer appropriate risk-return profiles through our understanding of the market volatility, and generate stable earnings.

- We are also bolstering our human resource development by sharing know-how within the company.